Testimonials

“We have been delighted with the service provided by Park Insurance, which has been professional, friendly and efficient. When we…

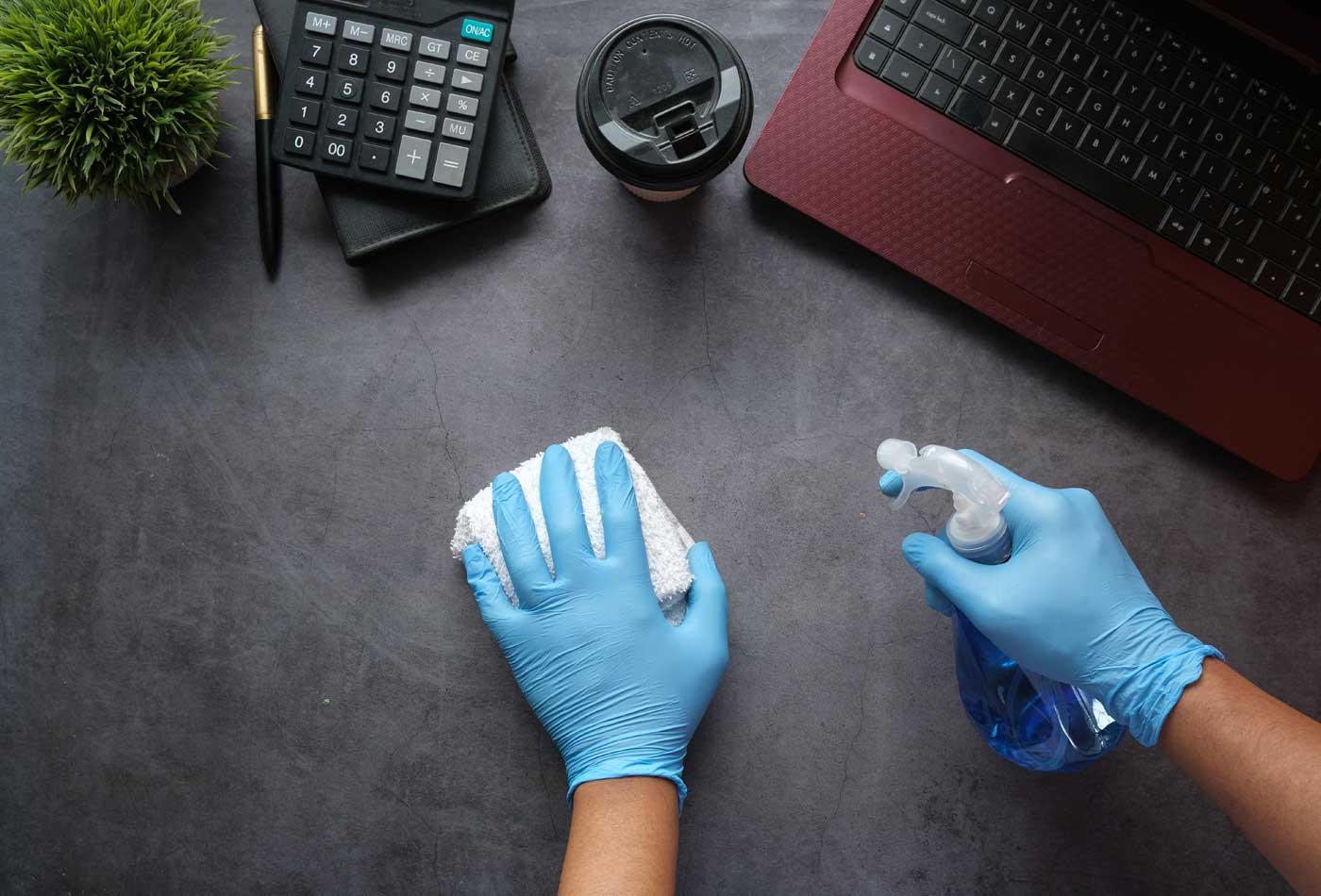

As a career that is founded on hard work, care and attention to detail, cleaner insurance makes sure that all the effort you put into your business is protected should anything go wrong.

When entering people’s homes or business premises and physically and chemically cleaning these properties, there is always a risk that something could get damaged or a member of the public become injured. Cleaning insurance takes these worries away, ensuring you’re financially protected should a claim be made against your business.

Whether you’re a self-employed cleaner kept busy cleaning the homes of your loyal regulars or a large company with a national office and several business cleaning contracts, cleaning liability insurance can protect your livelihood.

You or your employees are given the responsibility of entering someone’s home or commercial property and working closely with a range of valuable or sentimental items. You may find yourself cleaning in the vicinity of other people, meaning that a mishap could lead to their injury.

Handling cleaning equipment, using strong chemicals and creating slippery surfaces can sometimes cause accidents – even if you’re a careful and highly-trained cleaner. Being prepared for the unexpected means that no matter what size your business is, your company is protected if a claim is made against you or you suddenly find yourself unable to work.

Policies generally include:

If your work is based around cleaning, cleaning business insurance could be right for your business. Individuals who would benefit from this type of policy are:

Although your only legal obligation in terms of insurance as a cleaner is to include sufficient employers’ liability cover if you have staff, there could be major financial repercussions if you fail to insure your company.

The cost of paying an injury claim for a member of the public who slips on a spillage you created or the price of replacing an expensive item in a home or office could spell financial ruin for your business.

Having insurance gives the peace of mind to work with your specialist equipment and hazardous cleaning products in people’s homes and businesses. With powerful machines and chemicals under your control, you may constantly worry that you might damage their personal property. This can be a particular fear when you hire members of staff to clean on behalf of your company. Cleaner insurance negates this fear and lets you focus on doing a great job and growing your business.

You also won’t have to worry if your industrial vacuum breaks or if your entire cleaning stock is stolen from your van. Problems may arise – but when you have cleaning business insurance, they don’t have to put all your hard work at risk.

If you’re a small business or a self-employed cleaner who works alone, any expenditure within the business can feel like a worry. But whatever the scale of your cleaning business, budgeting for cleaning insurance should be a priority.

The cost of a cleaner insurance policy premium varies depending on the following factors:

The best cleaner insurance will include cover that reflects the individual needs of your business. The type and level you take out will impact the cost of your insurance, but savings can be made by increasing your voluntary excess.

At Park Insurance, we’ve been working with small business owners for decades, creating tailored insurance policies that offer all the protection they need. We always admire their entrepreneurial spirit and, therefore, try to use our extensive insurance expertise to make sure businesses are covered for all eventualities.

With our personal approach, we’ll take the time to get to know you and your business. Get in touch to see how Park Insurance can help keep your cleaning company safe.

“We have been delighted with the service provided by Park Insurance, which has been professional, friendly and efficient. When we…