If you’ve never heard of marine cargo insurance and hearing the words uttered now doesn’t spark any interest, chances are you don’t need to know what it is and will do just fine without reading on. If on the other hand you’re thinking, “hang on, I’m shipping x soon, this sounds like something I’ll need,” then read on to find out exactly what marine transit insurance is and how it can benefit you.

What is marine cargo insurance?

Marine cargo transit insurance protects goods that you’re transporting across the UK or abroad by sea, road, rail or air. Whether you’re moving your own personal items from point A to B or you’re a business importing or exporting overseas, a marine cargo insurance policy will offer financial protection.

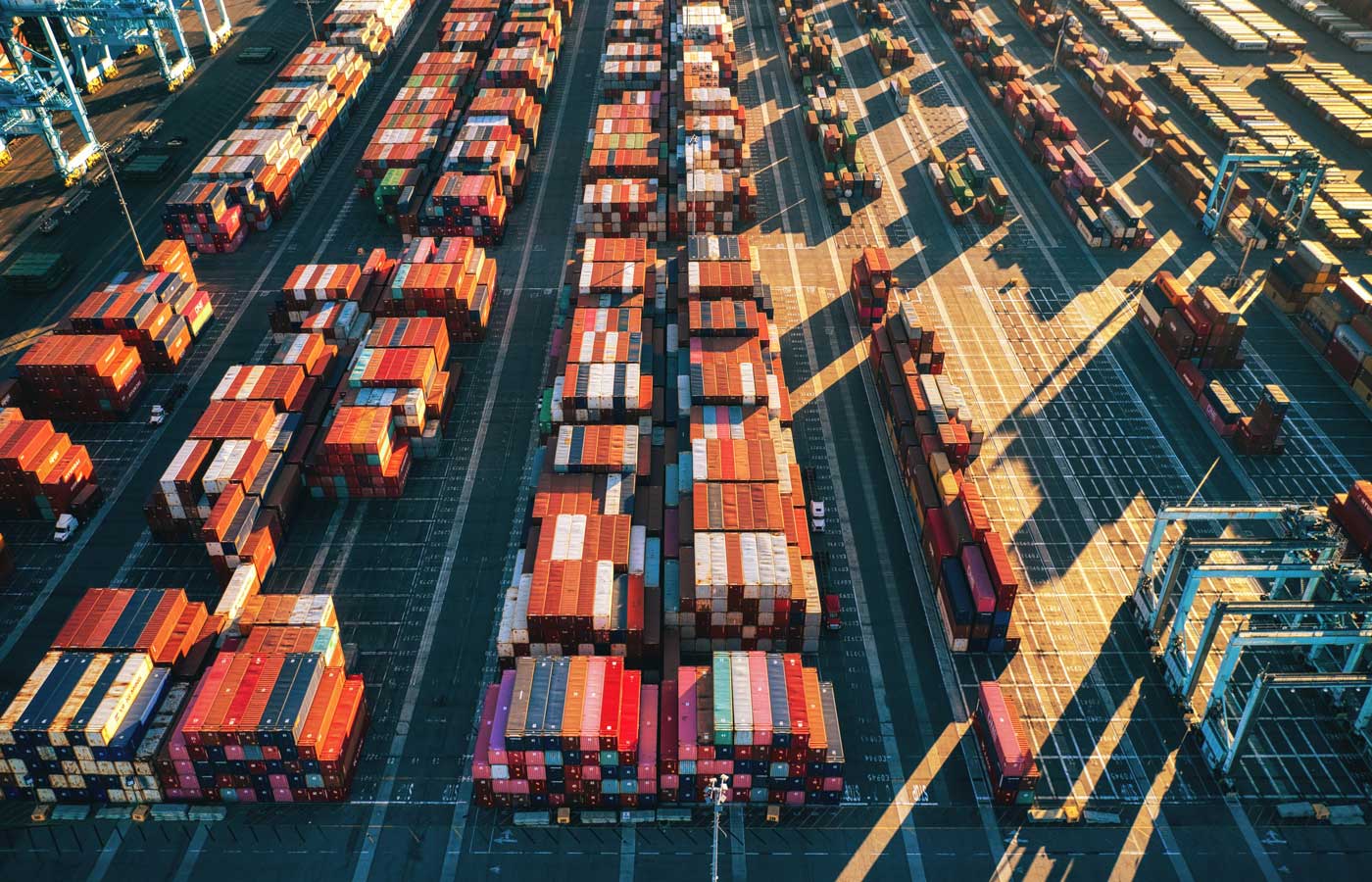

The UK is a hive of activity for imports and exports. If you’ve got goods joining this dynamic network, you want to ensure they’re safe, whatever happens.

When would I need marine cargo insurance?

Although marine transit insurance was initially devised for goods sent by cargo ships, today, almost any type of goods in transit can be covered by this type of insurance.

You might need it if you’re a UK company that exports goods abroad or imports from overseas into the UK. This means that import/export merchants, international sellers, online retailers and contractors could all need to secure a marine transport insurance policy.

As an individual, you can also take out this type of insurance to protect goods you send or receive. A typical example is when you’re moving the contents of your house from the UK to a new home abroad.

You should never assume that your chosen carrier has enough insurance to cover your goods. Your carrier’s insurance is generally only concerned with protecting their liability rather than the value of the goods they’re carrying.

What does marine transit insurance cover?

When goods are making their journey abroad, not only might they encounter a range of different transport modes, but they are also exposed to numerous risks. A marine cargo insurance policy will protect items against the following:

- Loss

- Accidental damage

- Water damage

- Theft

- Hijacking

What level of marine transit insurance cover do I need?

Insurers tend to consider numerous factors when working out the level of cover required. A standard calculation utilised is the value of your goods + the freight + 10%.

What are the benefits of taking out this type of insurance?

Moving goods from one country to another is quite a complex process, and it is unwise to assume that someone else within the transportation process is covering the value of your goods. An insurer such as Park Insurance will be able to walk you through issues such as INCOTERMS – trade terms which you may need to abide by when transporting goods.

By taking out a marine cargo insurance policy, you can be assured that you’re safeguarding your investment. It’s important to note that it is through this type of insurance that you will be able to claim back the full value of your goods.

Moving your goods over a long distance can be a legal minefield, and ensuring that your investment is protected for the entirety of its journey isn’t always straightforward. Park Insurance offers a trusted service where specialist insurance experts can curate a watertight maritime transit insurance policy to keep your finances safe and secure.

Park Insurance is a specialist broker that provides cargo insurance. We can tailor a policy that will suit all your needs in the following areas.

Marine Cargo Insurance

If you are either importing, exporting or responsible for moving or selling goods within the UK, then we can provide you with full cover against the physical loss or damage to those goods, including:

- Machinery

- Clothing

- Foodstuffs

- Electronics

- Pharmaceuticals

- Timber

- Fancy Goods

- Artwork

- Showman’s Equipment

Plus, many other commodities, whether these goods are being sent by either road, rail, sea or airfreight.

Cover can be arranged on either an Annual Policy or a Single Voyage Shipment.

Stockthroughput Insurance Cover

If we are looking to arrange import cover, this can be extended to include UK storage and re-distribution of your goods under a specialised umbrella cover called a stock throughput insurance policy.

Household Goods and Personal Effects

Whether you are moving abroad or within the UK, we can provide a tailor-made policy covering all your goods in storage and in transit. Cover can be extended to include your Motor Vehicle too.

Marine transit insurance for businesses

If you regularly ship cargo overseas, large or small you need sea freight insurance. This could be bulk orders of your product for overseas distributors, raw material, equipment or anything else – without financial protection to cover you for the loss or damage of your cargo, your business could be put into a difficult position. For small companies without the resources to absorb a financial loss such as this, the results could even be catastrophic.

Park Insurance can arrange affordable and robust marine cargo insurance which will cover you for any risks you feel are appropriate and which is tailored to your precise needs. We can provide you with cover for an entire year, or if you ship cargo relatively infrequently or you’re just looking to transport goods or equipment overseas as a once off, we can arrange a single voyage shipment.

We can also arrange stock throughput insurance cover which will protect your goods while they’re being stored in a warehouse prior to or after shipping has commenced.

Marine transit insurance for individuals

It’s not just businesses that can benefit from transit insurance though. Individuals who are moving overseas and need to transport their belongings should ensure that they have insurance which covers them in the event of something going wrong during the voyage. Equally, if you’re selling a vintage vehicle or other expensive luxury item to an overseas buyer, you need to insure it against theft, loss or damage during transit.

Park – Marine cargo policy specialists

Park Insurance is a specialist insurer with more than 20 years of experience in the sector. Whatever your marine transit insurance needs, send us an email or call us today to arrange cover which is competitively priced and fit for purpose, with no excess baggage.