If you own a second home, renting it out as a holiday home can serve as a useful source of income. Whether you’re looking to counter the soaring costs of living, pay off your mortgage a little quicker or simply top up your savings, if you’re savvy, renting out a holiday home can be a relatively hassle-free stream of income. With a little preparation and with the right insurance protection in place, your second home can boost your finances and take care of its own expenses.

The Rise of the Holiday Home

The world has faced an interesting few years thanks to the pandemic and one of the notable outcomes of this was the rise in “staycations”. Due to travel restrictions, many people chose to holiday at home, leading to a boost in business for holiday homes.

Though it’s much easier to travel abroad now, British holiday homes are still enjoying excellent occupancy rates. Whether your second home is in the UK or abroad, it’s a great time to consider renting it out as a holiday let.

Though homes in popular tourist destinations are always going to be highly desirable, as companies such as Airbnb have demonstrated, there is a wide market for short-term rentals no matter where a property is located. People love the comfort and convenience of staying in a home when they’re on business or visiting friends or family for a few days. So even if your property isn’t coastal or in the centre of a buzzing city, you may still have a rental market just waiting to be tapped into.

With so many companies making it easy to advertise and take payments for your holiday home, making an income from a second home has never been simpler or more viable. If you use your second home for short-term holiday rentals for enough weeks each year, rather than being viewed as an investment, in terms of taxes, the property is considered a business. If your holiday home does qualify for business rates, this is good news because it offers you tax advantages, including offsetting expenses and using Capital Gains Relief.

Home or Away

If you plan to rent out your second home, the first thing you need to consider is whether you are allowed to do so. Check with the local authority where your intended holiday let is located to see whether you’ll need to apply for permission to use the property as a holiday home.

If you have a mortgage on your second home, you’ll need to discuss whether letting a holiday home is an option. Some mortgage providers do not allow a property to be used for short-term lets. Don’t be disheartened if your current provider says no. A mortgage broker will help you find a lender that is willing to accommodate holiday rentals. Though it can take time and money to change mortgage lenders, you can try to absorb the expenses in the first year through rental fees.

For second properties located abroad, you must pay due diligence to the local rules and regulations for renting out a holiday home. In some countries, there are rules about the use of properties as holiday homes, driven by a need to provide affordable housing for local people. You should check both on a country-by-country and region-by-region basis to see where you stand.

Whether your property is in the UK or abroad, you’ll want to take out holiday home insurance that reflects your new use of this property and that takes into account any specific regulations associated with its location. This is an essential part of renting out a holiday home and should not be overlooked.

Working out your Finances

The costs of running a holiday let require careful consideration and you need to ensure that you are covering all the different expenditures related to your property and holiday home business when deciding your fees. While working out your rental charges you need to think about:

- Your monthly mortgage costs (if applicable)

- Your council tax or business rates

- Advertising/marketing costs, including your annual fees for hosting a website

- The cost of your cleaners

- The cost of your laundry service

- Gardening and maintenance costs

- Holiday let insurance

Preparing your Property

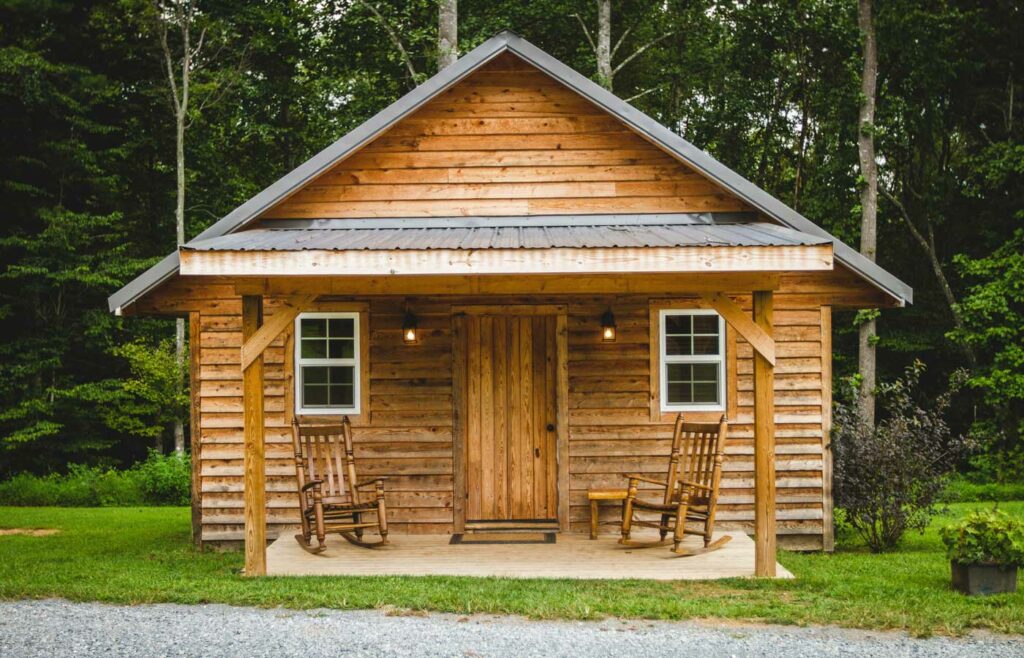

While it’s great news that the holiday home market is booming, it does mean that you face plenty of stiff competition. Before you’re ready to photograph, film and market your holiday home, put the leg work in to make it a property that stands out. This will be particularly important in popular tourist destinations or in areas where there are many holiday lets available. To help you get your home picture-perfect and up to scratch for the modern holidaymaker, follow our useful step-by-step guide:

- Work your way through that list of maintenance issues. From a leaky tap to a wonky cupboard door and scuffed skirting boards, get your jobs up to date because it will become much harder to pop in and fix problems once you have paying guests.

- While you’re servicing your second home, get to know the property’s local tradespeople. The relationships you forge with them could be invaluable if an emergency arises and you’re not close at hand to help. During this process, carry out a health and safety audit, making the requisite amendments to keep your property as safe as possible for guests such as checking smoke and CO2 alarms work correctly.

- Get the basics right. When letting a holiday home, you need to tick a lot of boxes. To help you provide your guests with everything they need for a comfortable and convenient stay, use your own home to compile a list of the utensils, appliances and equipment you find essential on a day-to-day basis. If you’re choosing to appeal to the luxury end of the market, once you’ve got the basics in place, you can add high-end appliances such as a great coffee machine.

- Curate the right aesthetic. You might love the way your second home looks, but you need to view the interior design through the eyes of your guests. Ideally, you should create a calm, tranquil environment so they can relax. This ambience can be created with either a safe, neutral colour palette and comfortable furnishing and accessories, or with a tasteful, minimalist interior complete with contemporary art. Don’t forget to add the personal touch by incorporating a nod to the property’s location with the likes of driftwood accents for a coastal property and rustic notes for a rural home.

- Spruce up the exterior of your property and the grounds. It’s important to make a good first impression when guests arrive because even if you’ve made the interior look spectacular, a weedy path or peeling paint on the window frames can leave guests feeling deterred.

- Enhance your property to make it more appealing to guests. Hot tubs are undoubtedly a boon to a holiday home and if you can afford to invest in one, you can raise your weekly rental prices and become more competitive in the local market. A working fireplace is very popular for autumn and winter rentals in countryside locations, but it takes some preparation on your part. You’ll need to maintain the fireplace, stock up on kindling and fuel and ensure your cleaners do a good job of keeping it looking neat and tidy.

- Opt for the best wi-fi available in your area. With so many people enjoying streaming in the evenings to unwind, a tip-top internet connection is viewed as a necessity by most holidaymakers. If you’re targeting the business-person market, this will become more vital, as they may be working from your property.

- Boost your eco-credentials. To stay ahead of your local holiday let market, make sure your property offers some sustainable features. Give your guests plenty of recycling options and consider installing an electric car charging port.

Marketing your Holiday Let

If the thought of marketing your own holiday home seems a touch overwhelming, you’re in luck. Holiday homeowners have a wealth of companies who will put in most of the hard work for you. By adding your property to a holiday cottage website or Airbnb, you benefit from a ready-made audience, a way to vet potential guests and a good booking and payment system. The downside is, of course, the fees you’ll incur for using their platform.

For those willing to run their own website and social media pages, you’ll benefit from the freedom of pushing forward your own property, easily running your own promotions and adding a far more personal touch. If you choose to market on your own, consider investing in booking software to keep your guest dates easily managed and to allow you to keep track of when you need to book cleaners, gardeners and maintenance.

Whichever option you choose, to attract guests you must display excellent images of your property. If your budget allows, bring in a professional photographer to capture each room, the exterior, and any interesting local features. If you’re doing it yourself, pick a bright day where natural lighting can work its magic on your spaces.

Managing your Holiday Home

When letting a holiday home, to successfully run your business and to stay within the local rules and regulations, you need to manage your property’s admin and financial affairs diligently. After you’ve worked out your planning permission considerations, and your council tax and business rates, you also need to ascertain whether you’re required to collect VAT from guests in your property’s locality.

There is no room for error when it comes to the turnaround of a holiday cottage. Often, there will be just a few hours between guests leaving and new guests arriving, so your cleaner must know when to come. You should also have a solid “plan B” in place to deal if your cleaner cancels at short notice.

Create a reasonable cancellation policy that protects your finances. Be willing to watch the local holiday home market, adapting your pricing and offers in line with the current climate. If you manage your own bookings, be sure to keep tabs on the rate you’ve charged for each booking to ensure that final payments don’t under or overcharge your guests.

Allocate time to answering queries from potential guests and always take feedback on board, responding politely. The public is known to be influenced by online reviews and the owner of a holiday home visibly dealing with complaints in a positive manner can help to negate the effects of a negative review.

Protecting your Holiday Let Business

When you’ve put your heart and soul into creating a lovely, welcoming holiday home for your guests, you want to do everything you can to protect both the property and the business. It’s important to find an insurer, such as Park Insurance, who will take the time to walk you through your changing insurance needs once you start letting out your second home.

Though home insurance, which tends to cover the building and contents, is fine for a property with a full-time resident, it is not suitable for short-term letting. If you fail to take out the appropriate holiday home insurance, you may find that you cannot successfully make a claim in the event of something going wrong.

In addition to protecting your holiday home as a physical asset, you should also protect the business side of your letting enterprise and put the cover in place to safeguard against claims made by your guests. For this reason, as well as protecting the structure of your property and its contents, holiday home insurance should include public liability cover. Public liability is very useful because it protects you should a guest claim personal injury or property damage while they stay at your holiday home.

Park Insurance has over two decades of experience helping property owners protect their most valuable assets. Offering a personalised and bespoke insurance service, when you get in touch with Park Insurance, our friendly experts will take the time to understand your needs before curating the best policy to keep your holiday home business safe and secure.